Preface – The Paradigm Shift to Online in Today’s Sourcing

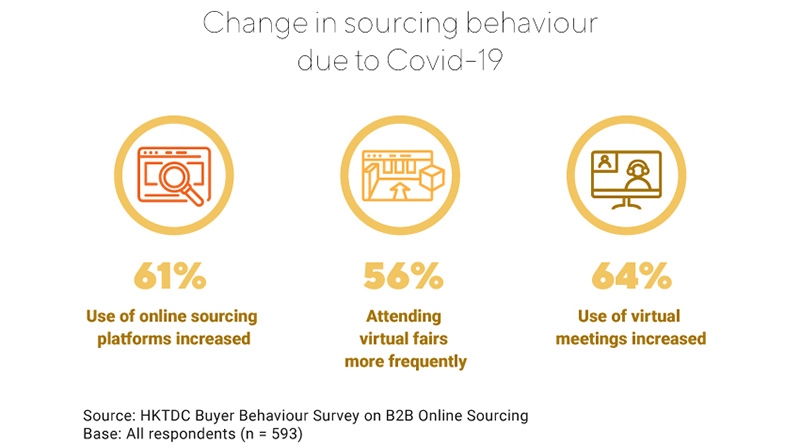

Over the past two years, the ongoing pandemic has forced buyers and suppliers all over the world to adapt their sourcing practices. In our new normal of travel restrictions and social distancing, the disruption of the global supply chain, increasing freight costs, stock shortages and shipment delays have emerged as major challenges to sourcing.

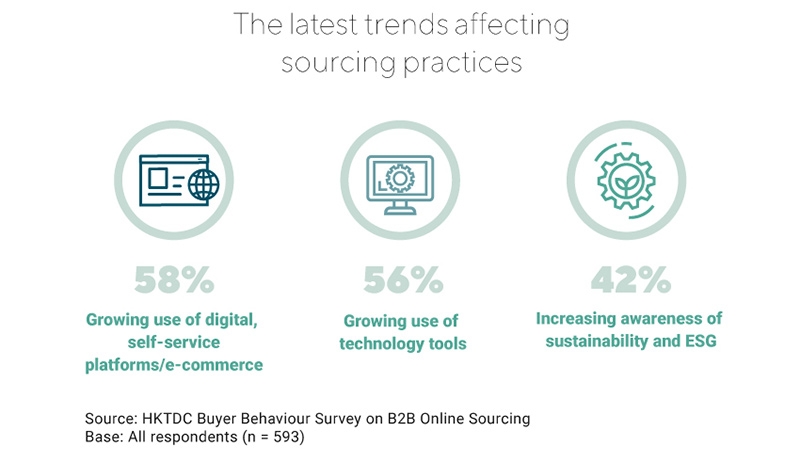

Sourcing workflows have been evolving to bypass these barriers. For buyers, the due diligence stage that used to take place primarily in‑person – namely pre‑sourcing research, supplier/product evaluation and selection – is now taking place online along with purchasing and post‑procurement stages. For suppliers, digital is fast becoming an essential part of conducting business with buyers’ growing usage of online self‑service platforms, e‑commerce, and technology tools such as video conferencing and instant messaging.

While a paradigm shift to online was already occurring prior to the pandemic, the progress of digital transformation has now become even more instrumental for buyers and suppliers. As digital tools establish themselves in this reshaped marketplace, companies are re‑evaluating the roles of physical fairs and virtual fairs, with the hybrid fair concept now emerging as a possible means to meet ever‑changing needs. The following paper explores the way forward for sourcing, with buyers and suppliers adapting to grow their businesses for 2022 and beyond.

The insights presented draw upon both the findings of qualitative interview and quantitative survey research1 commissioned by Hong Kong Trade Development Council (HKTDC) and general observations from secondary sources (including media reports and research from outside sources) covering industry trends and forecasts.

New normal impacting sourcing

The changing preferences of both business customers and end‑consumers are continuing to impact the sourcing landscape. Buyers are striving to remain nimble enough to identify emerging trends that can influence upcoming orders. These trends include the demand for greater product variety, growing awareness of sustainability, and the desire for personalised and customised items. As these are poised to become more mainstream among consumers, these trends may end up compelling buyers to work with an extended network of suppliers to source new product offerings.

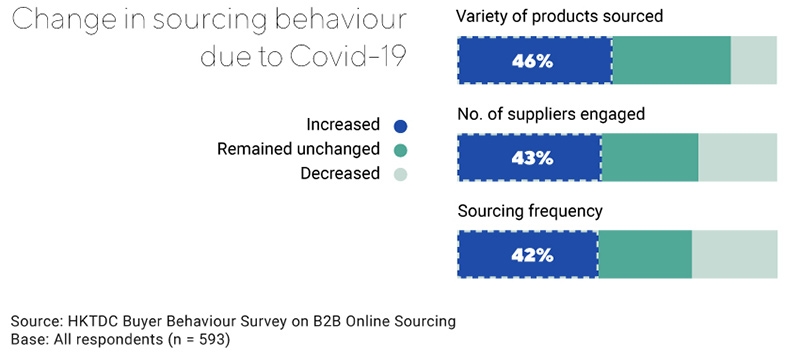

The desire for greater product variety is driving buyers to expand their networks

With physical fairs on hold, buyers are unable to meet with suppliers in person to better examine samples and get a feel for product trends. Meanwhile, end‑consumers continue to seek a greater variety of products. In order to meet this demand and generate new business, the HKTDC research shows that buyers are increasingly depending on online to search for new suppliers and products outside their regular established network. In the past year, 93% of surveyed buyers have used online sourcing platforms, and more than 40% of them are engaging more suppliers than they did prior to the pandemic. Nearly half of buyers said they are sourcing a wider variety of products to appease consumers, and one in three are sourcing orders more frequently with a higher average value.

Sustainability and ESG concerns trigger demand for eco-friendly products

As consumers are increasingly conscious of minimising environmental impacts and carbon footprints, buyers are more compelled to seek out products from suppliers that fit this profile. The HKTDC research found that increasing awareness of sustainability and ESG (environmental, social and governance standards) are materialising as key considerations for both business customers and end‑consumers in their product choices. With sustainability top‑of‑mind, innovative producers who utilise more environmentally friendly processes could very well stand to benefit.

“A trend for the past two years is the innovations in a sustainable direction. For final clients, especially in Europe, they are more conscious about the environment [and] about the impact of the co2 lifecycle. So that's why companies need to push [their] suppliers to innovate. Another trend of the sourcing also linked to this environmental conscious purchasing is to source from smaller companies that give us more environmentally friendly production.”

A buyer from the Home Products, Lights & Constructions category, Europe

Personalisation may be here to stay

Secondary research from a variety of sources shows that personalised items made according to a customer’s preferences are impacting buyer sourcing. Eschewing the “one‑size‑fits‑all” approach, personalisation enables brands to give their customers unique product experiences that are specially tailored to their needs and desires. Online sourcing platforms and suppliers may have to increasingly account for buyers’ needs to fulfil these customised orders that stand apart from general inventory. Although personalisation is not an entirely new concept, media reports suggest that personalisation is a factor to consider for brands in terms of both physical products and curated omnichannel experiences; Forbes notes that more than 50% of consumers2 have shown interest in purchasing personalised products for themselves and their friends and family, while AdAge reports that 60% of consumers3 are likely to become repeat buyers after a personalised experience.

“The orders from our customers are specific. We tailor-made their items. The reason why we don’t make purchases online is because we are looking for customised orders, not their inventory.”

A buyer from the Textile category, mainland China

Buyers’ evolving sourcing behaviour

During the pandemic era, the methods with which buyers carry out their job responsibilities have had to change significantly. Digital has become a necessary means as opposed to simply “nice‑to‑have”. Tasked with sourcing more diverse goods across a broader network, buyers and suppliers are now leaning on online sourcing platforms as a primary conduit. With all stages of the sourcing journey now taking place virtually, buyers are exercising due diligence to ensure they are working with the most trustworthy platforms and suppliers every step of the way.

The hunt for suppliers optimised for online sourcing

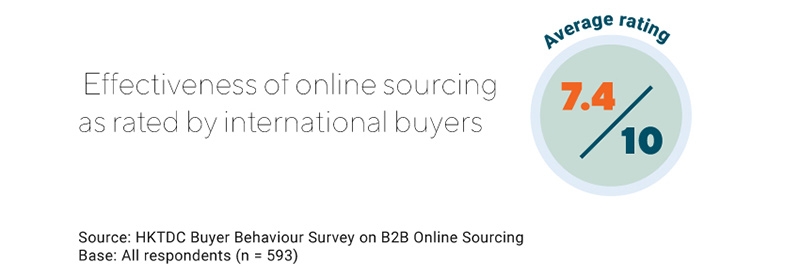

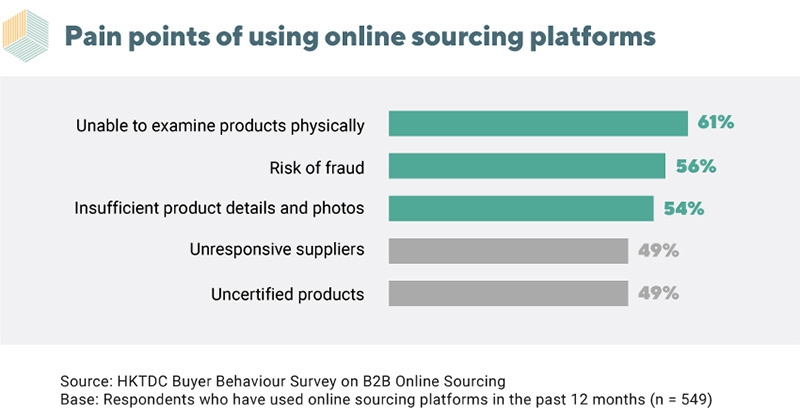

In their responses to the HKTDC survey research, buyers found online sourcing via web platforms, websites, mobile apps, and virtual meetings to be fairly effective overall. However, they are still finding online sourcing to be challenging at times, with the biggest issue being product and supplier authentication. Additional barriers that buyers mentioned included unresponsive suppliers and difficulty vetting products online.

Online is key for research and discovery, such as product comparison and trendspotting